4 Essential Questions to Ask Your Revenue Cycle Management Consultant

Navigating the intricate pathways of financial management in the healthcare realm can be a daunting task. Among the pantheon of professionals who can assist you in taming this beast, a Revenue Cycle Management (RCM) Consultant holds the most promising beacon of guidance. Their expertise in financial operations and regulatory compliance can be invaluable for your healthcare organization. However, selecting the right RCM consultant involves substantial deliberation and critical analysis. To assist you in making a well-informed decision, consider the following four essential questions.

-

What is the full scope of your RCM experience and expertise?

RCM is an extensive field encompassing patient registration, insurance verification, coding and billing, payment collection, and revenue generation. The consultant’s proficiency should ideally span the breadth of these areas. In addition, having experience in your specific healthcare sector—be it a hospital, outpatient clinic, or specialized medical practice—would be an added advantage. If they are well-versed in the nuances of your environment, they can provide more customized advice and strategies.

-

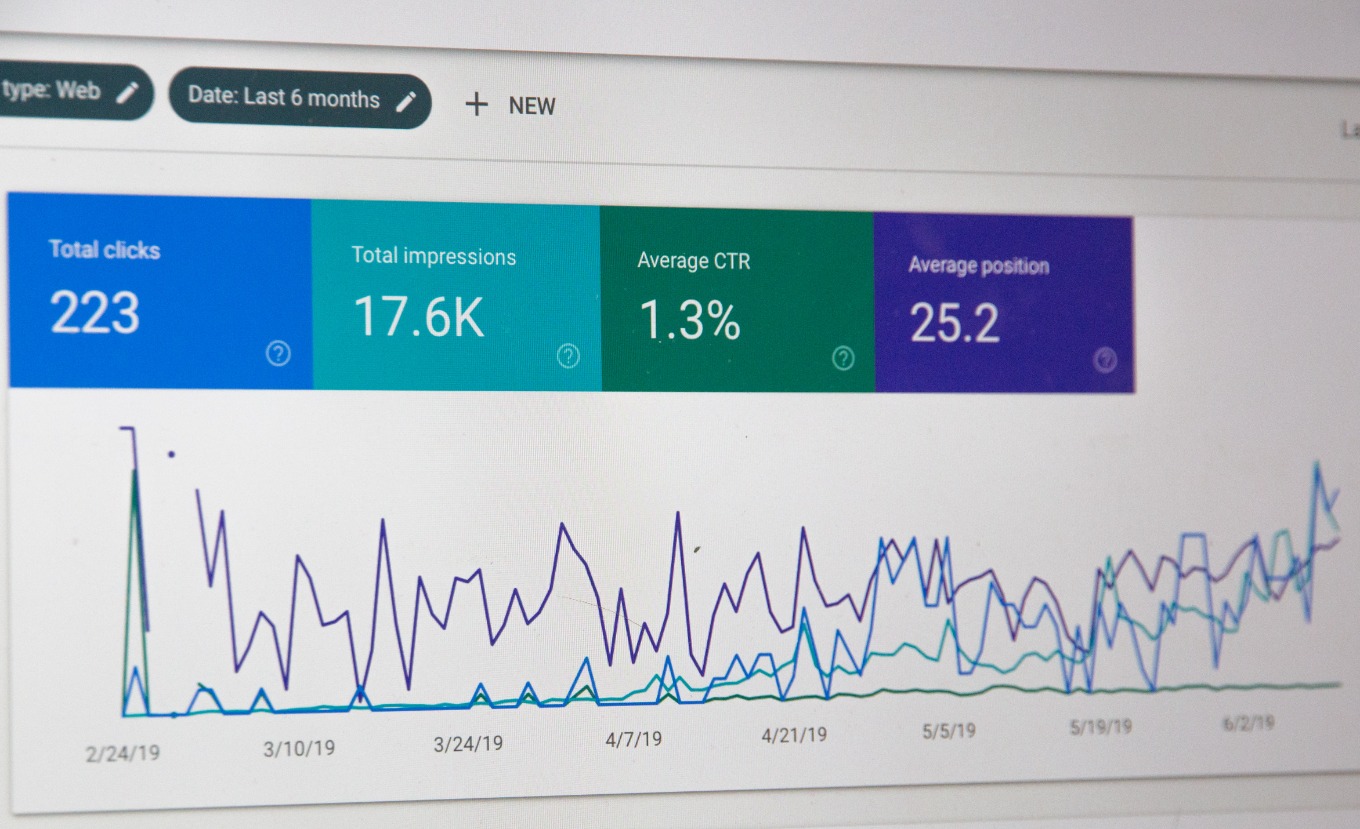

How do you approach data analytics in RCM?

The power of data analytics in RCM cannot be overstated. Properly harnessed, it illuminates trends, highlights inefficiencies, and uncovers opportunities for revenue optimization. Look for a consultant who leverages advanced data analytics tools and methodologies. These can include predictive modeling (which utilizes historical data to forecast future trends), segmentation (which groups patients based on various characteristics to tailor billing practices), and root cause analysis (which identifies the fundamental causes of billing errors or revenue leakage). The consultant’s aptitude in managing, analyzing, and interpreting data directly correlates to their ability to enhance your revenue cycle performance.

-

How do you ensure regulatory compliance?

In an industry heavily moderated by complex laws, maintaining compliance is not a choice but a necessity. Violations can lead to hefty penalties, tarnished reputation, and, in the worst-case scenario, license revocation. Your RCM consultant should have a comprehensive understanding of relevant healthcare laws and regulations, including the Health Insurance Portability and Accountability Act (HIPAA) and the Affordable Care Act (ACA). They should also be updated on any recent and upcoming legislative changes that could impact your revenue cycle management.

-

Can you provide any client references or case studies?

The proof, as they say, is in the pudding. Any RCM consultant can wax eloquent about their capabilities, but the real validation comes from their past performance. Request the consultant to share client references or case studies demonstrating their proficiency in enhancing revenue cycle outcomes. These would offer insights into their problem-solving abilities, strategic thinking, and commitment to client success.

The correlation between a thriving healthcare organization and a well-oiled revenue cycle is irrefutable. An adept RCM consultant can play a cardinal role in bridging the gap between the two. These four questions serve as the compass that directs you towards the right RCM consultant.

Among the pantheon of professionals who can assist you in taming this beast, a Revenue Cycle Management (RCM) Consultant holds the most promising beacon of guidance.